CBP Compliance Program Setup

CBP Internal Audit & Compliance Program

Build a real, in-house compliance department in 90 days

Build Your in-house Audit & Compliance Department in 3 months

Most importers treat CBP compliance like a side job. Brokers file entries, forwarders move cargo, factories send partial paperwork — and it “works”… until a CF-28 or CF-29 arrives.

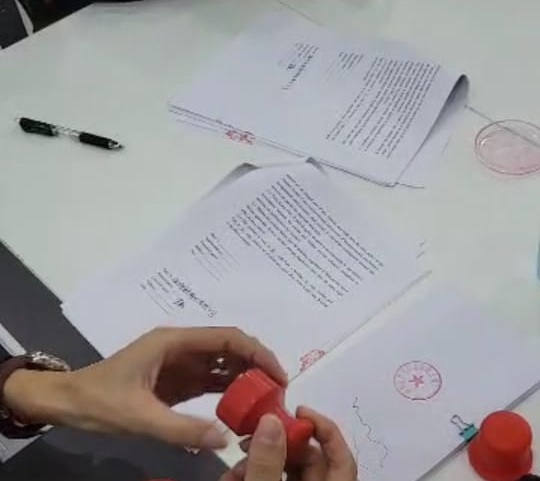

We co-create your audit playbook, contracts, evidence packs, and controls so your team can respond to CBP within 24–48 hours, every time.

The Gap Most Importers Don’t See

What we see every day:

- No single owner for compliance

- No internal system to track classification, COO, valuation, or ISF

- Evidence scattered across brokers, suppliers, and inboxes

- Factories refusing BOMs, origin proof, or affidavits

- Invoices, wires, and entry summaries that don’t reconcile

By the time documents are “found,” damage is done: storage fees, penalties, delays, flagged shipments, and the start of deeper scrutiny.

The Risk Timeline

- Day 0 — CF-28 arrives. Panic begins.

- Days 10–20 — Supplier delays, mismatched docs, unclear ownership.

- Days 30–45 — Storage, demurrage, revenue loss, deeper CBP scrutiny.

We don’t just audit you. We build your internal audit department so this never happens again.

What We Build

In 3 months, your ops and legal team implement a repeatable CBP audit system with our guidance. You learn by doing.

By the end, you will:

- Own a working CBP compliance department

- Run quarterly audits on your own

- Hold lawyer-backed contracts that compel supplier cooperation

- Produce a full CBP response binder in 24–48 hours

Program Phases

Phase 1 – Gap Map & Ownership (2–3 weeks)

- Kickoff workshop with ops, legal, leadership

- Assign audit champions

- Map risks across suppliers, SKUs, processes

Deliverable: Gap Analysis Report

Phase 2 – System & Legal Build (4–6 weeks)

- Ops: SOPs for classification, COO, valuation, ISF, seal logs, invoice→wire reconciliation, supplier evidence packs

- Legal: Local lawyers draft/update contracts. Jurisdiction, penalties, indemnity, inspection rights. Staff training on affidavits and declarations

Deliverable: Internal Audit Playbook v1

Phase 3 – Mock Audit & Training (2–3 weeks)

- Run a full mock CBP audit with your staff

- Correct issues live and finalize memos and logs

Deliverable: First Audit Report + Corrective Action Plan

Phase 4 – Handoff & Scaling

- Final CBP Audit Binder

- 12-month audit calendar

- Team trained to self-audit quarterly

- Optional: Asia Agent quarterly refresh & legal renewal

Deliverables

- CBP Audit Binder Template

- Supplier Evidence Packs (BOM→HS, COO memos, licenses, affidavits, geo-photos)

- Legal Toolkit (contracts, affidavit templates, penalty provisions)

- Internal Audit Playbook (SOPs, logs, escalation paths)

- Training & Mock Audit

- Audit Calendar & Dashboard

Outcomes

- Importers own compliance — not brokers

- CBP response binder ready in 24–48 hours

- Staff run quarterly audits independently

- Contracts force supplier cooperation

- Scalable system for new SKUs and suppliers

Who This Is For

- U.S. importers sourcing from China and Vietnam

- Teams relying on brokers and forwarders for compliance

- Brands expanding SKUs and suppliers

- Companies that have faced CF-28/CF-29 — or want to avoid it

Investment

Typical range: US$18,000–$52,000 per project

Scope depends on supplier count, SKU complexity, team size, and legal contracting depth.

Why Choose Asia Agent for CBP Compliance Program Setup

- No remote shortcuts — every supplier verification is done face-to-face in China or Vietnam, with geo-tagged evidence.

- Enforceable contracts — drafted with local lawyers to compel cooperation, inspections, penalties, and indemnification.

- Supplier leverage — we negotiate through refusals, escalate when needed, and document non-cooperation.

- End-to-end compliance — classification, valuation, origin, AD/CVD, UFLPA, recordkeeping, and internal controls under one program.

- Audit-proof documentation — controls, memos, and evidence designed to withstand CF-28, CF-29, detentions, and Focused Assessments.

- Capability transfer — your team learns by doing; you own the binder, the SOPs, and the process after handoff.

Program-Ready Checklist:

What “Good” Looks Like

Your organization is considered “program-ready” when you can demonstrate:

- Single point of ownership for customs compliance with defined governance and escalation paths.

- CBP Audit Binder template populated for priority SKUs (classification, COO, valuation, rulings, and essential-character analysis).

- Supplier Evidence Packs (factory license, capacity validation, BOM→HS mapping, origin proof, affidavits, geo-photos).

- Valuation controls — assists, royalties, commissions, and invoice→wire reconciliation documented and tested.

- UFLPA traceability from raw material to finished good, including transport, payroll/roster where applicable, and upstream supplier mapping.

- Legal toolkit — enforceable supplier contracts with jurisdiction, inspection/audit rights, penalties, and indemnification.

- Pre-entry internal audit — invoice vs. packing list vs. BL vs. ISF vs. 7501 aligned and logged, with exception management.

- Recordkeeping & version control — minimum five-year retention policy with indexed access (who/what/when).

- Quarterly self-audits scheduled with metrics (e.g., % SKUs with memos, ISF on-time rate, exception log closure time).

- Fallback plan for non-cooperative suppliers (alternate sources, third-party verification, or stop-ship criteria).

Build Your Program Before CBP Asks

Request a consultation today.

We’ll review your supplier and SKU profile, map your risk gaps, and design a 10–12 week plan to stand up your in-house CBP compliance program—with the binder, SOPs, contracts, and trained staff to run it.

Get Started →

CBP Compliance Program Setup – FAQ

A CBP compliance program is an internal system for managing U.S. Customs obligations. It covers tariff classification, country of origin, valuation, ISF filings, and recordkeeping. Without a structured program, importers sourcing from China or Vietnam risk penalties, detentions, and repeat audits.

You can’t avoid all audits — CBP selects importers randomly and by risk profile. But a documented compliance program shows “reasonable care”. When auditors see binders, SOPs, and supplier affidavits ready, issues are resolved faster, often without escalation.

CBP auditors expect:

-

Clear tariff classification memos for each SKU

-

Valuation records (assists, royalties, related-party pricing)

-

Country-of-origin proof with substantial transformation analysis

-

UFLPA traceability for goods from Asia (cotton, polysilicon, seafood, aluminum, PVC, etc.)

-

Supplier affidavits, contracts, and BOMs that match invoices and payments

Common red flags include:

-

Repeated CF-28s (Requests for Information) or CF-29s (Notices of Action)

-

Valuation gaps between invoices and bank wires

-

Importing high-risk goods from China (textiles, solar, aluminum, seafood)

-

Country-of-origin shifts (China → Vietnam routing without proof of transformation)

-

Inconsistent HS codes across entries

Yes. If importers cannot provide clear and convincing evidence, CBP can seize or exclude shipments. This risk is especially high under the Uyghur Forced Labor Prevention Act (UFLPA). Goods from China with missing raw material records are at high risk.

Customs brokers file entries. They do not run internal audits, build SOPs, or train staff to manage CBP obligations. A compliance program ensures you own your audit defense rather than relying solely on third parties.

Most programs take 10–12 weeks. Asia Agent builds the binder, trains your team, and runs a mock audit to ensure you are ready. By the end, your staff can self-audit quarterly without outside help.

-

On-the-ground supplier verification in China and Vietnam

-

Lawyer-drafted contracts enforce supplier cooperation

-

Hands-on training — your team learns by building the binder

-

Audit-proof evidence prepared to withstand CBP’s scrutiny

-

Scalable system that grows with new suppliers and SKUs

Yes. CBP audits are becoming more frequent, especially for China-related imports. Passing once doesn’t guarantee the future. Having an internal compliance program reduces repeat exposure.

Yes. E-commerce brands are increasingly audited due to direct-to-consumer imports. Having SKU-level memos, valuation worksheets, and supplier affidavits ensures they can continue shipping without disruption.

The system includes:

-

Supplier and raw material mapping

-

Worker rosters and payroll records where applicable

-

Supplier affidavits proving no Xinjiang content

-

Full transaction flow (POs, invoices, payments, shipping docs)

This level of traceability is now mandatory for many imports from China.

Build your own in-house compliance department.

Our team guides your staff step by step, from gap mapping and SOP creation to mock audits and legal-backed contracts.

Contact Us Today

Don’t wait for CBP to knock. Build the muscle now and face every audit with confidence.